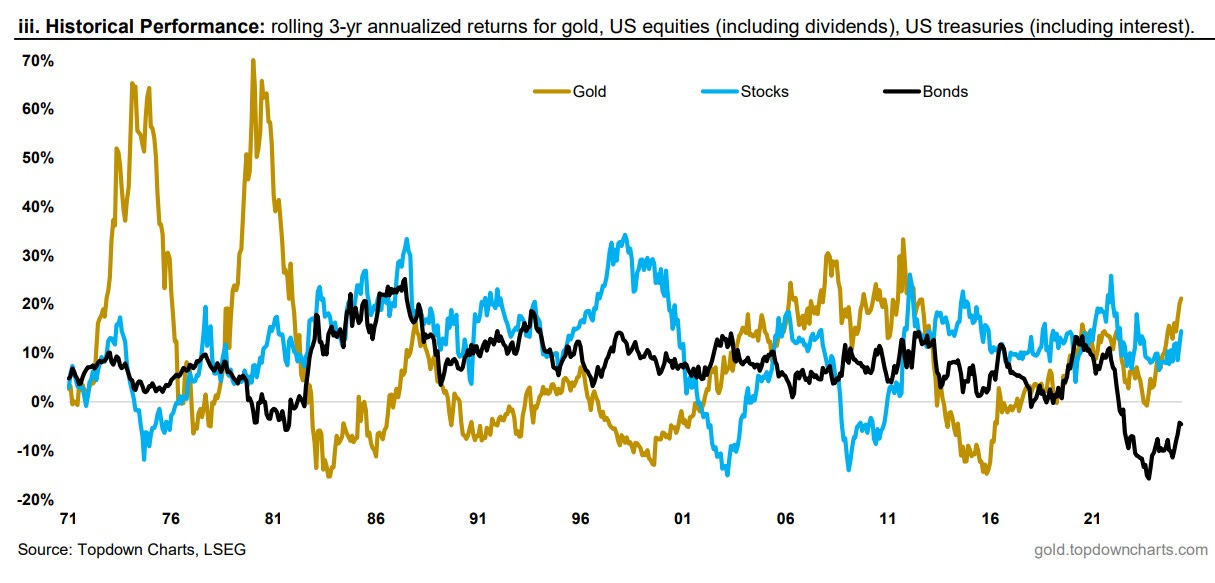

Congratulations, gold bugs, your long, painful wait is ending. The following chart shows the three-year rolling average annualized returns for stocks, bonds, and gold, with the latter now winning.

Gold is holding its gains even as it moves into its seasonally weakest stretch. No “sell and May and go away” so far.