From the Archives: Is A Silver "Deficit" The Same As A Shortage?

Setting the table for a big move

Silver has (finally!) had a great few months:

Is this the big move that takes our favorite metal to triple-digits?

Maybe. Here’s a post from this newsletter’s early silver coverage that explains the current bull market.

Is A Silver "Deficit" The Same As A Shortage?

Originally published April 21, 2023

The Silver Institute just published some supply/demand numbers that, at first glance, are about as bullish as it’s possible to get for a commodity. Here’s how Reuters covered the story:

Record Demand Pushes Silver Into New Era of Deficits, Silver Institute Says

Global demand for silver rose by 18% last year to a record high of 1.24 billion ounces, creating a huge supply deficit, the Silver Institute said on Wednesday, predicting more shortages in the years to come.

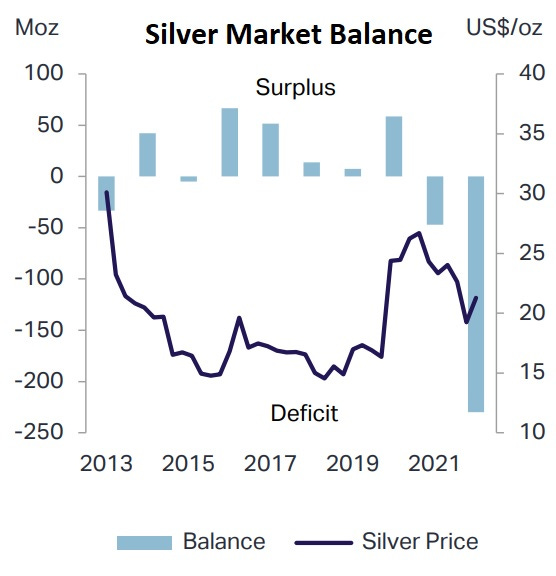

The silver market was undersupplied by 237.7 million ounces in 2022, the institute said in its latest World Silver Survey, calling this "possibly the most significant deficit on record".

It said 2022's undersupply and a 51.1 million ounce shortfall in 2021 had wiped out cumulative surpluses from the previous decade and predicted further undersupply of 142.1 million ounces this year.

"We are moving into a different paradigm for the market, one of ongoing deficits," said Philip Newman at consultants Metals Focus, which prepared the Silver Institute's data.

Here are the relevant charts, starting with supply, which has been declining irregularly for a decade — though a big part of the recent decline was due to covid lockdowns and so might be reversed in coming years :

Global silver demand shows a big jump in 2022, part of which is a rebound from lockdown-era lows, especially for Indian Jewelry demand.

The result was a massive deficit in 2022:

The trillion-dollar question

How much of this imbalance is due to lockdown distortions, and how much is now built into the structure of the silver market?

The answer? Some but not all of the deficit is here to stay. Industrial demand, led by solar panels, is likely to keep growing. And investment demand for bullion coins and Asian wedding-gift jewelry should be robust in our suddenly inflationary and unstable world. So let’s say demand stays strong but not necessarily 2022 percentage gains strong, while supply grows but only slowly, leaving the market in long-term deficit.

What does that mean for silver’s price? Here to tell us is silver analyst Ted Butler, who’s been chronicling the paper traders’ silver market manipulation for years. He views what’s happening now as an important turning point:

Goofy Conclusions From the Silver Institute

Hot off the press is today’s just-released world annual silver survey from the Silver Institute. As previewed a couple of months back, the Institute is reporting flat total supply (mining plus recycling) and sharply increased demand growth of 18% or 186 million oz, resulting in the highest silver deficit in modern times of 237 million oz.

The survey then goes on to (try to) explain that despite the axiom of the law of supply and demand that more demand than supply (by a large margin) must result in higher prices, that silver prices were lower on average over the year 2022 than the year before. The Silver Institute’s (Metals Focus’s) pithy explanation for something that should be impossible under the free law of supply and demand, namely, prices moving lower when demand is greater than supply was due to “institutional activity” in silver. Isn’t that just marvelous? I suppose “institutional activity” sounds a lot more dignified and proper than does blatant price manipulation.

The fact is that the only possible explanation for there being much greater demand than supply and prices falling (as the Silver Institute is reporting), is if someone is monkeying with the price. ”Monkeying with prices” is a bland term for what the collusive COMEX commercials do for a living. I guess price manipulation is a term to be avoided at all costs in these reports, despite the fact that all the data in the survey point to that inescapable conclusion.

Don’t worry, I’m not about to launch into another ramble about the ongoing COMEX silver (and gold) manipulation. By this time, you either see it or refuse to see it. More important is that, thanks to the undeniable facts published by those that obviously refuse to see that silver is manipulated in price (like the Silver Institute), it doesn’t matter much any longer who sees the manipulation or not. That’s because the unalterable effects of what a long-term price manipulation (suppression) in silver has wrought is far more important than who sees it or not.

The reason the Silver Institute is reporting a gaping deficit in silver and flat production growth for more than a decade is precisely because prices have been artificially suppressed and manipulated over this time. Nothing, other than price manipulation, is capable for the specific set of facts laid out in this survey. It’s not possible to have more demand than supply, to a record level, and for prices not to explode higher. The good news for silver investors is that the artificial depressed prices have existed for so long and silver inventories have been so thoroughly depleted that the silver manipulation appears to breathing its last gasps. Any day, week or month is all that stands between where we are in silver prices currently and where we’ll be looking down at in a very short time. Sure, we have to be prepared for whatever the last tricks the collusive and crooked COMEX commercials may have up their sleeves, but the hard data on actual supply and demand is so compelling that those dirty tricks won’t matter for much longer.

So is a deficit the same thing as a shortage? Ted Butler seems to think so, in the sense that a prolonged deficit eventually produces a shortage, which in turn leads to higher prices. Maybe a lot higher.

Silver investments (speculation) are not consumed. Just look at the glut of junk silver hitting the market now that people realize they need cash now rather than maybe saving silver dimes to trade for eggs in a post-apocalyptic future. Stacked silver is supply, not demand.

Great post… and timely.

Silver is a Tier One Asset and yet very few know it.

Silver is on very few (if any) critical mineral lists for any country or government.

That’s about to change soon and very soon.