In the life of a gold explorer, there comes a time when the big questions have been answered. The drilling and modeling have done their job, and the property has been defined. Company management, along with everyone else who’s been paying attention, knows what’s in the ground and whether it can become a profitable mine.

If the answer to that last question is yes, the wait begins for the explorer’s next and final stage: A buyout by a senior miner, hopefully at a price that makes the explorers’ early investors very happy.

Yesterday (January 3), an explorer from our Portfolio announced drill results that pretty much take it to that stage, where the viability of its deposit has been established and all that remains is the buyout.

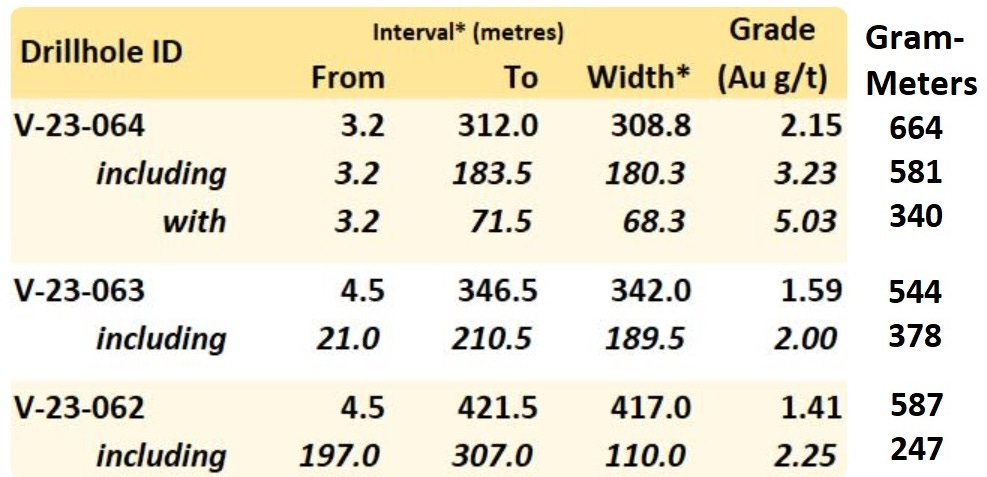

Here’s a snapshot of yesterday’s drill results. To interpret them, recall that “gram-meters” — derived by multiplying the width of an intercept by the grade of the metal intercepted — is a useful metric. A reading of 100 puts a drill intercept in the top 5% of such things, and a large number of 100+ gram-meter holes indicates a viable resource.

Our explorer’s latest gram-meter readings are at the far right of this table:

These are ridiculously good numbers. But — here’s the kicker — they’re just par for the course on this property. Our explorer has been reporting similar results for over a year and with this last batch has pretty much made its point: The resource is consistent (one analyst likens it to a bowl of soup where each spoonful is the same as any other), the grades are pretty good, and the metal starts near the surface, making it both easy and profitable to mine. Estimates of the total number of ounces run as high as 10 million, which would imply 500,000 ounces per year for 20 years. This is, in short, the kind of property that moves the needle for a senior miner, so expect one of them to step up in 2024 with an offer that’s higher than the current share price.