Think of a mining company’s life as a step function. It starts out as a handful of guys with a piece of land that a geologist told them might contain rocks worth digging up. They raise some money through a modest IPO, hire one or two drills, and start poking holes in the ground.

Some of the drill results turn out to be impressive. And boom, the stock spikes and everyone wants a piece of their action. That’s the first phase change, from greenfield project to possibly viable explorer.

But the people piling in after those initial drill results don’t realize that the next big phase change is years away and requires the raising of more money and the drilling and analyzing of many, many more core samples. And none of these drill results (unless they’re insanely great or horrendously bad) will have the share price impact of that first batch. Investors, as a result, get bored and move on and the stock languishes.

But eventually the luckiest/most astute exploration companies manage to finance and drill their way to enough data for a “maiden resource” report that explains what they’ve found and whether mining it will be profitable. That’s when a junior miner becomes real, and investors revalue its stock to take its higher status into account. It’s also when the big miners start calling to talk buyout.

So a good place to buy into an exploration company is after the exhaustive drilling and dilutive financing is out of the way and the maiden resource is about to be released. If the report good, the company ascends to that next, more exalted valuation level. If the report is great, the buyout speculation shifts into high gear and the stock can spike.

A Real-World Example

Eloro Resources owns a massive portfolio of properties in Bolivia, Peru and Quebec, including an 82% interest in the La Victoria gold/silver project in Peru (near Barrick’s Lagunas Norte Gold Mine and Pan American Silver’s La Arena Gold Mine) and an option to acquire a 100% interest in Iska Iska, a Bolivian polymetallic property.

Drill results have been good-to-great, with the most recent batch showing decent silver equivalent grades and extremely wide intervals (see In Search Of The Next 50-Bagger for why grade and width matter). From the January 31 press release:

The silver grades in DHK-27 are the highest and most extensive yet intersected in the Santa Barbara deposit. 50% of this 860m long hole, drilled from Huayra Kasa due west at -45 degrees, returned reportable intersections averaging 172.09 g Ag eq/t.

Holes DHK-26, DHK-28, DHK-29, DHK-30 and DSB-42, which returned multiple intersections, are additional holes collared in the Huayra Kasa area that tested the eastern margin of the High-Grade Zone at Santa Barbara. Highlights include:

222.51g Ag eq/t (28.44g Ag/t, 3.11% Zn and 0.26% Pb) over 53.90m and 99.76 g Ag eq/t (32.59g Ag/t, 0.11 g Au/t and 0.54% Zn) over 82.38m (DHK-26).

79.22g Ag eq/t (26.62g Ag/t, 0.35% Zn and 0.35% Pb) over 141.56m including 162.77g Ag eq/t (67.00g Ag/t, 0.55% Zn and 1.30% Pb) over 23.85m (DHK-28).

176.28g Ag eq/t (19.10g Ag/t, 2.29% Zn and 0.27% Pb) over 21.30m and 82.48g Ag eq/t (5.07g Ag/t, 0.21 g Au/t, 0.78% Zn and 0.18% Pb) over 69.18m (DHK-29).

130.69g Ag eq/t (7.19g Ag/t, 1.83% Zn and 0.48% Pb) over 42.17m and 129.98g Ag eq/t (19.71g Ag/t, 1.50% Zn and 0.57% Pb) over 72.31m including a higher-grade portion of 208.42g Ag eq/t (33.10g Ag/t, 2.37% Zn and 1.00% Pb) over 34.64m (DSB-42).

Don’t worry about understanding every contraction and acronym. Trust me when I say these are extremely good drill results.

And now for that maiden resource

Eloro intends to release its maiden resource by the end of the 1st quarter. Jay Taylor, who covers the miner in his Gold, Oil and Tech Stocks newsletter, expects it to be impressive: “They are uncovering what looks to be one of the greatest new silver discoveries with several hundred million ounces likely with tin being a significant byproduct. I think the maiden resource will stun the market.”

The rest of the checklist

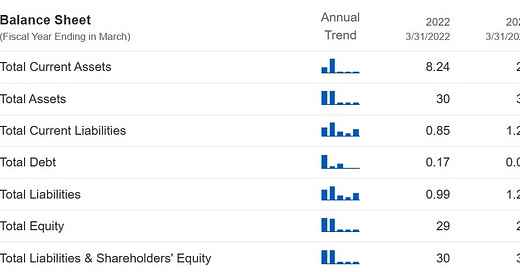

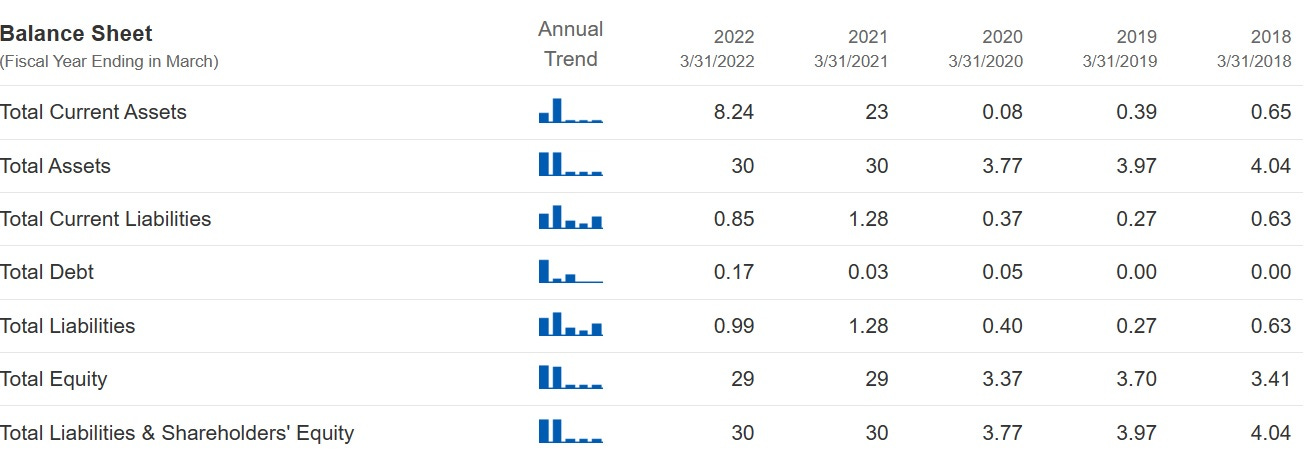

Balance sheet. Eloro raised about $7 million in January, which means no new unpleasant financing announcements for a while. And its balance sheet is pretty clean in any event, with total liabilities about 1/30th of total equity.

Management: Old but experienced. The CEO and VP of Exploration each claim 40 years in the business, which is a good news/bad news situation. They‘re certainly experienced, but (unless they started right out of high school) are of an age when normal people start slowing down (speaking from personal experience here). The General Manager of the company’s Bolivian arm claims 30 years in minerals exploration and was president of the Bolivian Geological Society from 2010 until 2017. And high-profile geologist Quinton Hennigh is listed as a technical advisor.

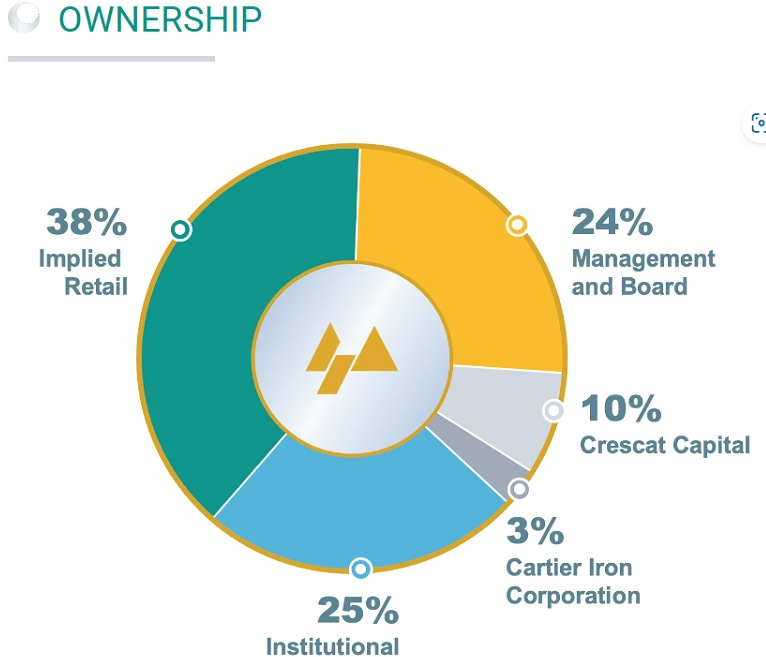

Share structure: Management owns an unusually large share of the company, which means their interests are (probably) aligned with other shareholders.

Political risk – here’s the problem: Bolivia and Peru host numerous mining companies, which would normally make them pretty good jurisdictions. But right now, they’re dealing with some serious political issues. From the New York Times:

Peru’s Foreign Minister Concedes There’s No Evidence Criminals Are Behind Protests

In a stark admission, Peru’s foreign minister contradicted its president about the origin of deadly protests shaking the country, saying in an interview this week “we don’t have any evidence” that the demonstrations were being driven by criminal groups.

Protests that began over an ousted president have roiled Peru for almost two months, leaving nearly 60 people dead, most of them civilians, and the country deeply divided over problems of excessive police force, inequality and corruption. A central strategy of Peru’s new, increasingly hard-line president, Dina Boluarte, has been to claim that the most violent demonstrators are organized by narco-trafficking groups, the illegal mining industry and political activists in nearby Bolivia.

From USA Today:

US reissues travel advisory for Bolivia amid protests: 'Exercise increased caution'

The U.S. reissued a travel advisory for Bolivia Thursday amid recent protests.

The State Department reissued its Level 2 warning for the country, advising travelers to "Exercise Increased Caution" due to civil unrest.

Across the country, Bolivians participated in a "national assembly" led by the opposition Wednesday to discuss proposals, including whether or not to resume protests that began in December following the arrest of Santa Cruz Gov. Luis Fernando Camacho.

Protesters ended blockades earlier this month that had largely isolated the rich Santa Cruz region from the rest of Bolivia for more than 15 days, but leaders said the roadblocks could resume to press demands that the government free the region’s governor.

To sum up, Eloro has great drill results, solid management, decent finances, and an imminent (and possibly excellent) maiden resource report — against a backdrop of regional civil unrest. I’d call it a buy on the imminent phase change but a cautious one due to political risk. Watch the news and if things calm down consider Eloro a strong long-term buy and hold.