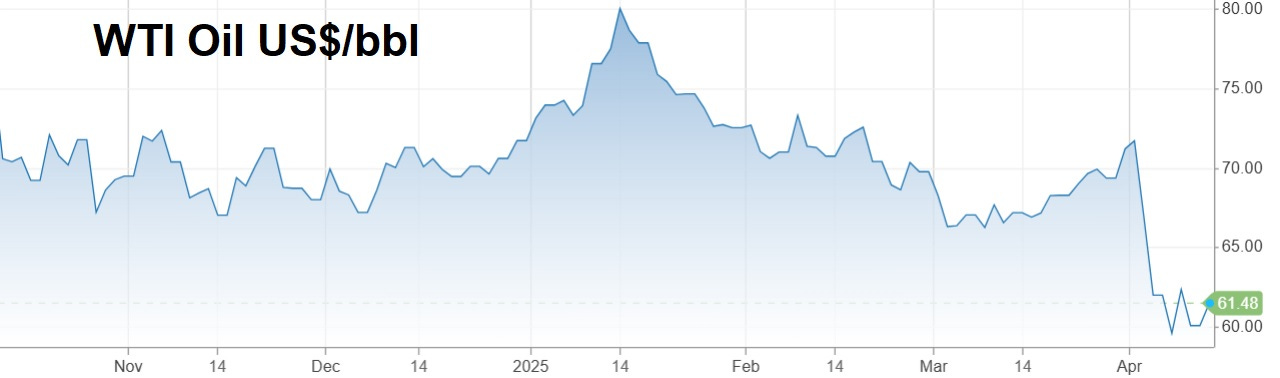

Talk about cross-currents. Oil, which affects the cost of pretty much everything, is down about 15% so far this month. That’s extremely deflationary.

Housing, meanwhile, is right up there with oil for its impact on the cost of living. And home price inflation is rapidly headed for zero overall, with many formerly hot markets already falling at double-di…