Before we discuss what happened in 2024, let’s jump ahead to the lesson that it teaches us:

Uncertain, possibly chaotic times are coming, so caution is crucial when building a portfolio of commodities stocks. Don’t pile into good stories. Instead, use low-ball bids, dollar cost averaging, and put writing to gradually add to high-quality stocks at the lowest possible cost. Volatility creates both risks and opportunities, so embrace the latter while avoiding the former.

With that out of the way, here’s what happened:

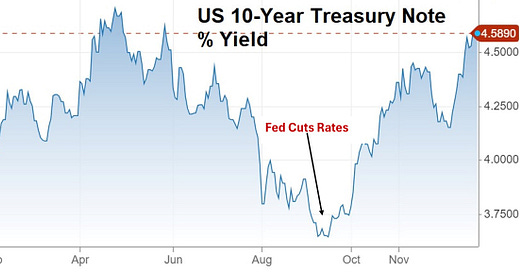

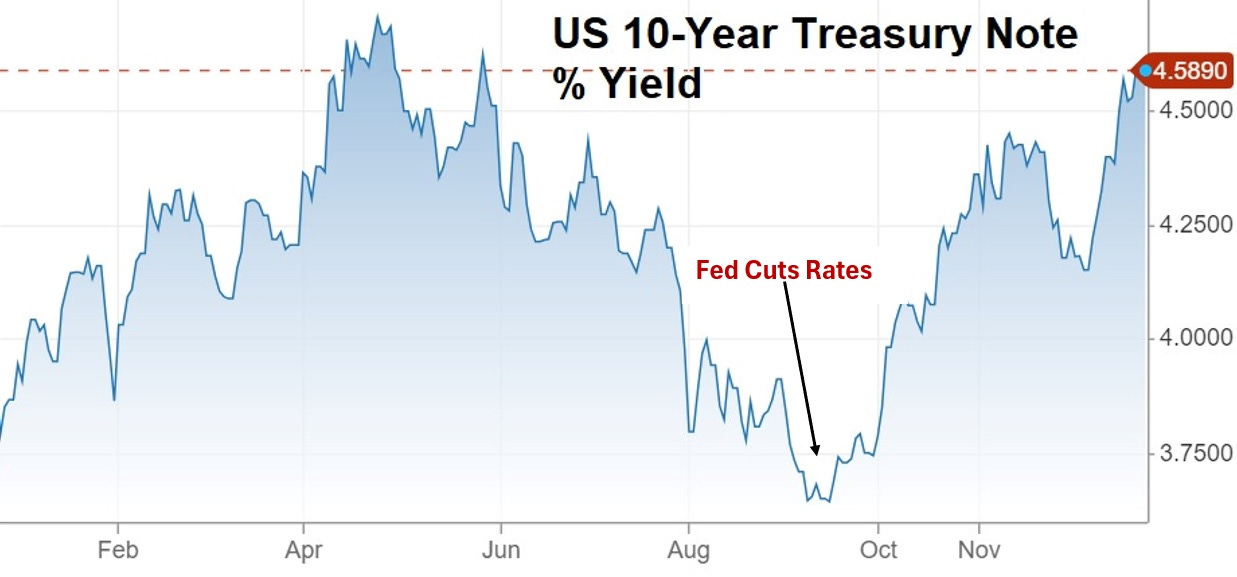

In September, the Fed — despite above-target inflation, priced-for-perfection stocks, and unaffordable houses — decided to cut interest rates. Easier money normally sends rates down across the yield curve, and in November, investors bet on that happening again, igniting “Santa Claus” rallies in everything from tech to cryptos to some commodities.

But this time, the bond markets didn’t cooperate. Instead of falling, interest rates spiked, raising mortgage rates and pretty much every other kind of borrowing cost.

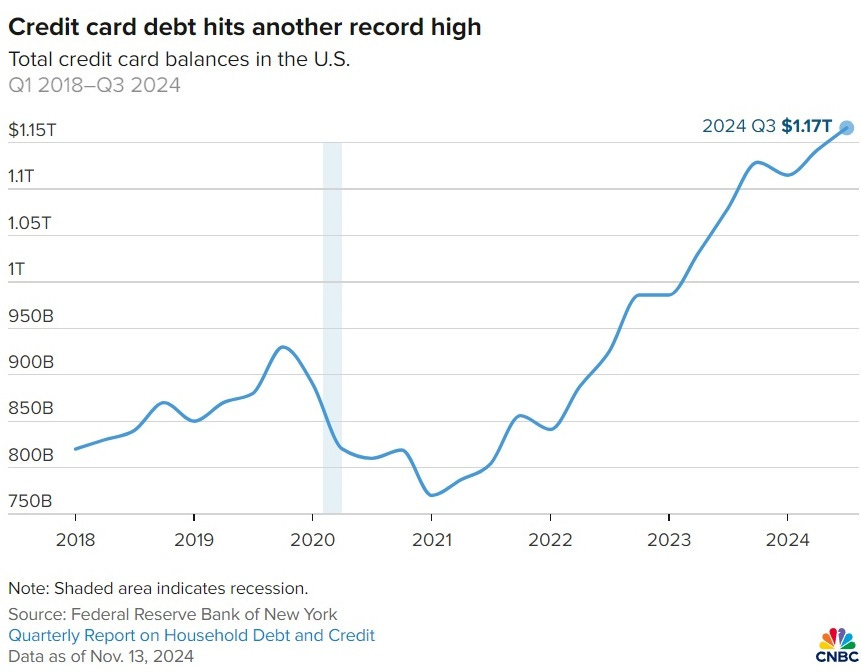

This sudden shift to “higher for longer” slammed into an economy that’s running out of available money…

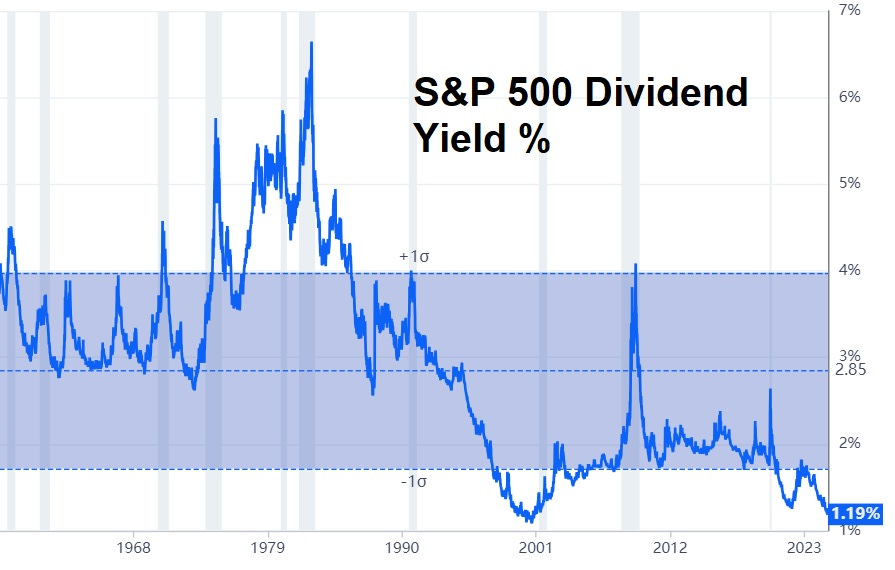

… and stocks that in the aggregate yield only 1.2%, versus the 4%-5% now available on bank CDs.

The stage was set for a brutal finale to what had otherwise been a good year. And that’s exactly what happened. Here’s the NASDAQ’s last five trading days of 2024. Note the precipitous drops.

What About Commodities?

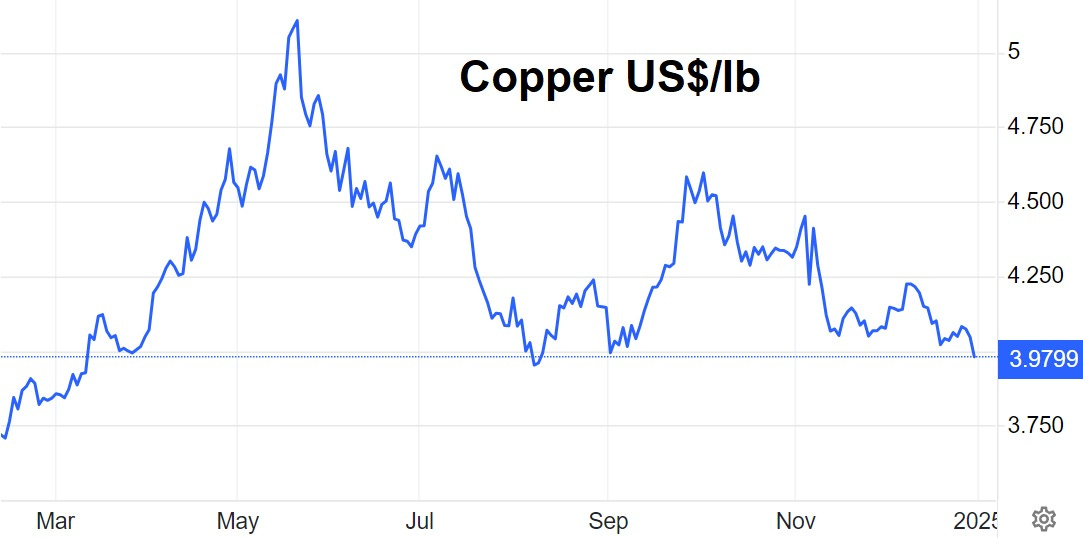

Gold held up pretty well in the face of rising interest rates and falling equities. As this is written, it’s still above $2600/oz. But other commodities are under pressure. Copper, for instance, spent the second half of 2024 in a downtrend:

As a result, many of our Portfolio stocks gave back some of their 2024 gains in December, despite reporting good operating and financial results. Here’s a representative example: